There are many factors to consider when deciding between financing and leasing a car, which is why it’s important to break down the key differences. Let’s start with the monthly payment.

Leases typically have lower monthly payments than loans because you only pay for the part of the vehicle you use during the lease term. This is why there’s a residual value (the car’s value at the end of the lease). On the other hand, loan payments are higher because you’re paying off the entire value of the car over the loan term. So, if you compare a lease and a loan with the same term – no down payment and the same interest rate – the loan will cost more per month.

To keep it simple, lease payments are calculated by taking the depreciation of the car (the difference between the car’s sale price and its residual value) and dividing it by the number of months in the lease). The higher the residual value, the lower the depreciation and the lower your monthly payment. Monthly interest is calculated based on the car’s full value and added to the depreciation amount to determine the total lease payment.

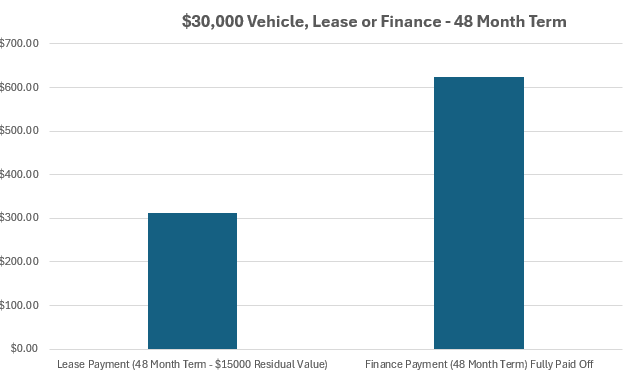

If we use an example of a $30,000 vehicle that has 0% lease and finance rates, we can clearly illustrate what was described above.

LEASE: $30,000 sale price, less a $15,000 buy back (residual). $15,000 divided by a 48-month term = $312.50 per month. (Note: since our example is assuming a 0% interest rate, there was not an interest charge to be added to the payment).

LOAN (Finance): $30,000 sale price divided by the same 48-month term = 625.00 per month (exactly double the lease payment but the loan is paying off the whole vehicle).

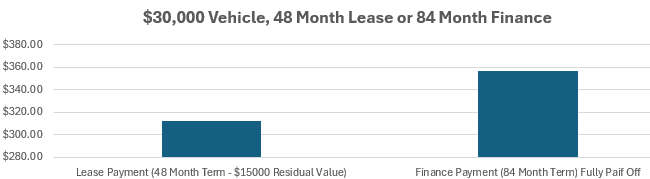

After considering this example, you might wonder why everyone doesn’t lease their new vehicle. That would be the case if banks and car manufacturers’ (OEM) finance companies only offered 48-month terms. However, both banks and OEM finance companies also offer longer-term financing options, such as 60, 72, 84 and even 96-month terms.

New car dealership financial service offices have effectively promoted the 84-month (seven-year) finance term to compete directly with the lower 48-month lease payment. Using the same example, an 84-month loan for a $30,000 vehicle would result in a monthly payment of $357.14, which is very close to the 48-month lease payment.

I compared several 48-month lease calculations with 84-month loan calculations for various popular vehicles. The lease payments ranged from $10 to $53 less per month than the loan payments. As mentioned, OEMs often alternate between offering better interest rates for leases one month and better rates for financing the next. Therefore, it’s crucial to always request comparable quotes for both payment options.

In conclusion, you’ve learned about the term lengths that can equalize the monthly payments of a lease and a loan. With this knowledge, you can create a shortlist of new vehicles you’re interested in and use a lease/loan calculator to see if they fit your budget.

Go to CarCostCanada® and use their build, price and calculator tools to come up with your vehicle shortlist and put you on the right road to making the best vehicle purchasing decision. CarCostCanada is a one-stop shopping tool that allows you to do all the pricing research on one website as opposed to bouncing around several OEM websites.

Jim Matthews is the President, General Manager and Co-Founder of LeaseBusters. Jim launched LeaseBusters is 1990 and is considered one of Canada’s leading experts on new vehicle leases, lease-take-overs and vehicle lease (re)marketing. Jim can be reached directly at [email protected]